An Easier Ride? How to Meet Customer Expectations with Autonomous Driving Technology

What started as mere science fiction is now becoming a reality. Fully autonomous driving capabilities and even Robo-Taxis and Shuttles are already being introduced in some markets, complementing the more basic Advanced Driver Assistance Systems (ADAS). The future is here, now, and we can grasp it with our bare hands.

After a relatively long period of hype, the technology is now rapidly maturing and becoming increasingly prevalent. Many drivers already rely on ADAS features, such as automatic emergency braking and lane departure warning and correction systems. While this technology makes driving even more convenient for consumers, most automotive players are still uncertain about customers’ specific autonomous driving needs and concerns.

To market autonomous driving technologies effectively, automotive players need to understand a wide range of factors relating to questions such as: How are customer expectations evolving? What are the specific pain points, and how can they be effectively mitigated? How much do customers value autonomous driving features and what is their willingness to pay for different solutions? How relevant are established brands to market these solutions to customers and are there regional or other demographic differences?

To shed some light on these questions, we recently conducted the Autonomous Driving Consumer Survey 2022. We surveyed more than 2000 participants from three regions, namely the US, Europe, and China, through a representative online panel. Our findings reveal sentiments that may raise some eyebrows but will undoubtedly give valuable food for thought to all kinds of stakeholders involved in making autonomous driving a reality. This includes, for example, car manufacturers, technology companies, but also (local) authorities, and research institutions.

Cars and brands are still a subject of desire

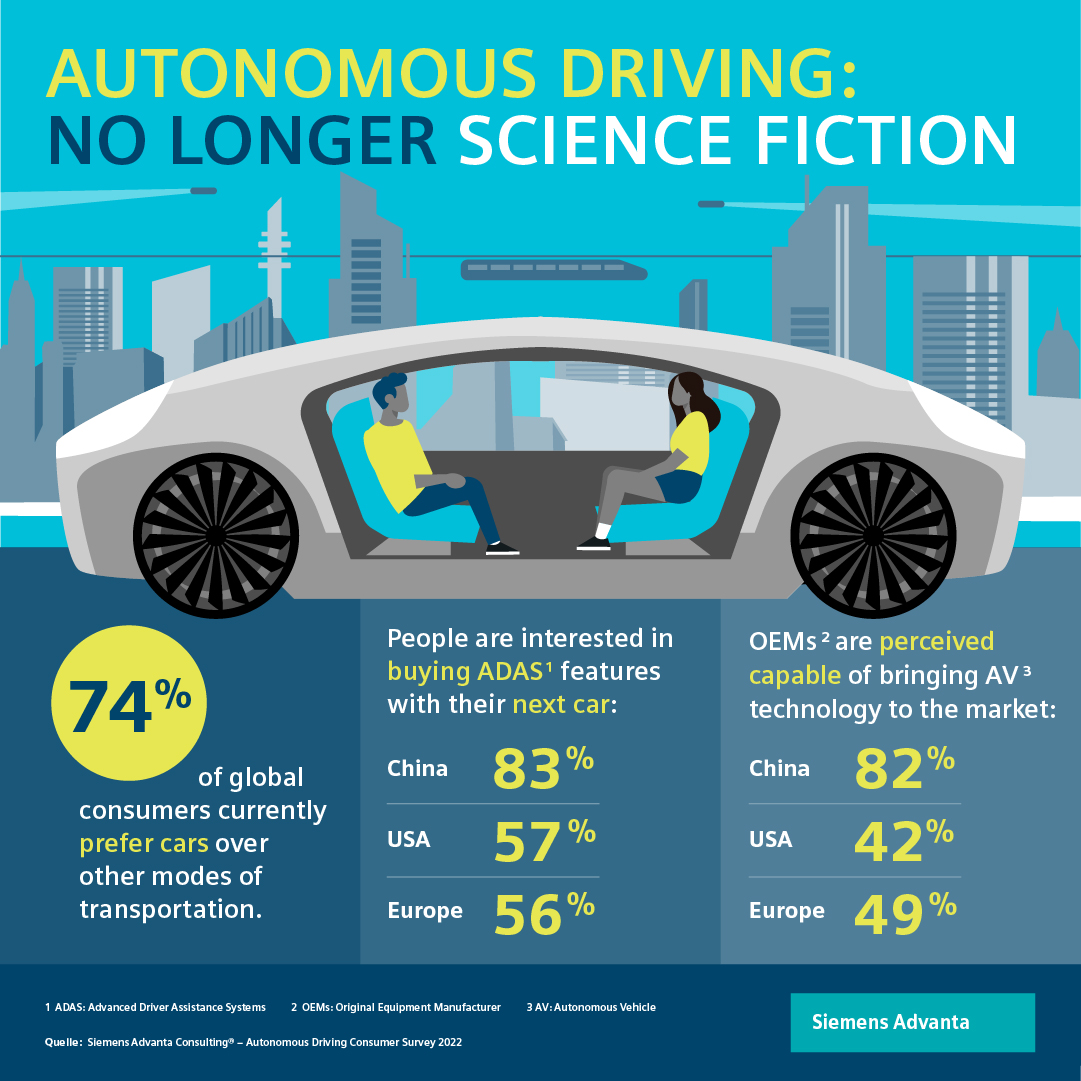

Our results show that, without a doubt, people still love cars. 74% of consumers surveyed globally expressed a preference for cars over alternative modes of transport under current conditions. Even under ideal conditions (e.g., perfect availability and reliability, safety and cost, of alternative modes of transportation), the majority (59%) of respondents prefer cars. Cars will, therefore, likely stay relevant in the foreseeable future.

However, the role of currently leading car manufacturers in the future of mobility has often been questioned over recent years. Many have predicted that traditional OEMs will become increasingly irrelevant. Our results contradict this notion by showing that customers have high perceptions of traditional OEMs’ abilities to introduce AV technologies to the market. Chinese consumers are especially confident (82%), followed by Europeans (49%) and Americans (42%). Furthermore, most consumers have more confidence in traditional OEMs than in new tech companies in this regard.

On the contrary, new electric vehicle (EV) makers such as Tesla, divide regional opinions. In the US, consumers are more confident in these companies (60%) than in traditional OEMs (38%). Chinese consumers have comparatively more balanced perceptions, assigning 68% and 63%, respectively. European consumers, however, have similar faith in both new EV OEMs (52%) and traditional OEMs (52%). Contrary to common perception, these findings highlight the high relevance of both cars and traditional car manufacturers to consumers.

Driving automation needs an image boost

Chinese consumers are especially interested in ADAS, with 83% intending to purchase these features with their next car. Furthermore, 87% of them would go so far as to switch to a different car brand if that meant securing better ADAS implementation.

In Europe and the US, however, enthusiasm for ADAS is substantially lower. 56% of Europeans and 57% of Americans are interested in purchasing ADAS features, while 44% of Europeans and 49% of Americans would consider switching car brands in exchange for improved ADAS features. Still, the results highlight that ADAS features are a key differentiator for OEMs, even in these markets.

More importantly, manufacturers in Europe and the US need to establish why consumers are reticent. When asked about the reasons, the most common responses revolved around the arguments “unawareness of features” or “the system is too expensive.” These findings imply leeway for a better explanation of ADAS features and their benefits to consumers and/or finding alternative bundles or pricing models to address respective concerns.

Addressing such consumer concerns and reducing uncertainty should be a top priority for manufacturers before marketing the technology.

When asked about the reasons for their doubts, customer's most common responses revolved around the arguments “price of systems” or “unawareness of features”.

“How to pay” as a key question

There are essential factors to consider when trying to overcome obstacles for vehicle or feature purchases: pricing and payment models and differing preferences between consumer groups.

The attitudinal differences between China and the West are also evident in pricing and payment models. For connectivity services, 78% of Chinese consumers accept new payment models (e.g., pay-per-use or subscription-based), compared to just 42% of American and 34% of European consumers. However, even more striking is the difference in uncertainty in this regard, with 9% of Chinese, 29% of American, and 31% of European consumers who are not sure of whether to accept such payment models. The acceptance of new payment models for functions on demand diverges similarly (China 75%, US 36%, Europe 30%) and shows comparable rates of consumer uncertainty.

There are also important preference differences between consumer groups for other demographic variables, such as age. In the US and Europe, acceptance is lowest in the over-60s and highest in the under-30s. While this is not surprising, it’s the acceptance rates among the over-60s in China that are striking. A massive 65% of these older consumers accept new payment models, compared to only 22% of American and 15% of European over-60s. OEMs need to be aware of such demographic differences while ensuring that each payment model’s benefits are crystal clear to their consumers.

What OEMs must do to overcome these differences

What do OEMs need to take away from the messages consumers are conveying? For us, it nails down to three different imperatives.

1. Develop products that fit customers’ needs

OEMs must sharpen their focus on products that circle around customers’ needs. Developing autonomous driving features for the sole purpose of doing it won’t bring a competitive edge. Manufacturers need to realize how to make autonomous driving technologies as comfortable, easy to handle, and therefore as desirable as possible. Manufacturers should ensure their product strategies reflect consumer needs on, for example, smartphone integration and connectivity services, especially in China.

2. Develop clear pricing models that fit customers’ needs

As previously mentioned, customers’ wishes towards pricing models differ strongly, for example between regions and generations. Customer centricity and proximity are vital to addressing customer preferences and reducing uncertainty in this regard. OEMs and other automotive players should offer tailored pricing models to relevant customer sub-groups to maximize their chances of successfully positioning their solutions in the market.

3. Educate!

One of the key challenges identified in this survey is that consumers, especially in Western markets, are often somewhat reluctant to the new offerings and indifferent in their preferences. Therefore, automotive players need to advance their efforts to explain the benefits of the technology and the advantages of new payment models. This will be crucial to ensure high adoption rates and stable revenues early on. If people know “what is in it for them,” they will be more likely to press the purchase button.

Human behavior dictates highway ahead

Similar recently conducted surveys show that the ‘lack of consumer demand’ is not a barrier for autonomous driving technology adoption. Our findings support this notion. The demand is there, it just needs to be untapped. The process of getting there is simple: stay close to your customers and educate them as thoroughly as possible to tackle potential obstacles along the way.

With increased awareness, the potential to gain business value from autonomous driving is not something from a sci-fi movie anymore. It’s just around the corner.

Who knows? Maybe flying cars or time machines are next!

Download the survey

How do consumers perceive autonomous driving these days? Will the new technology influence their purchasing and mobility decisions? We recently conducted a survey asking more than 2000 participants globally this exact question. Find our key learnings here.

Our expert

Contact Us

Contact Us