All Electric 2035

All-Electric-2035

Transition to an all-electric mobility in Europe: What does it take to make it happen?

Transition 2035 to an all-electric mobility in europe

What does it take to make it happen?

The EU agreement for zero emission vehicles specifies that all new cars registered in Europe will be emission-free by 2035. Therefore, the transition to an all-electric mobility in Europe is reshaping the entire automotive industry. To ensure the transformations’ success, the right charging infrastructure needs to be in place. Furthermore, the value chain of electric vehicle batteries will experience additional challenges considering the rapid increase in demand for battery cells, as well as geopolitical supply chain dependencies. Finally, the transition to an all-electric mobility will greatly impact the people working in the industry by creating the need for reskilling and the risk of job reductions.

Three main challenges have been identified that could pose a risk to the transition

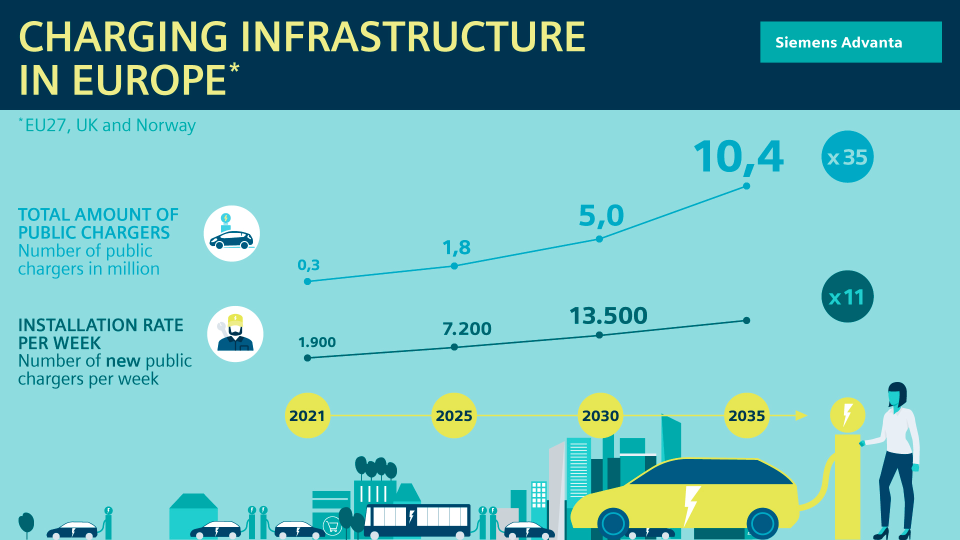

The installation speed of public chargers needs to accelerate elevenfold. Already today, long lead times for electrical installations are required and the alarming low number of specialists in this field.

If heavy-duty trucks are to be electrified, a separate public infrastructure allowing for megawatt charging along European highways needs to be installed including more than 4.000 public charging points.

Europe needs to reduce supply chain dependencies since over 75% of the mineral refining and battery cell production are currently controlled by China.

Charging Infrastructure

The targets for charging infrastructure in 2035 are set: charging pools should be available every 60km along major EU highways and a charging capacity of 1kW per battery electric vehicle (BEV) is to be made available. By linking charging infrastructure targets to the car parc development of electric vehicles, this ensures that both developments are aligned and at the same speed.

To achieve the set target in Europe, by 2035 more than 10 million additional public chargers need to be installed and the installation speed needs to 11 times faster. This implies an increase of public charger installations per week from less than 2.000 in 2021 to more than 20.000 in 2035. Today, we are already experiencing long lead for electrical installation and a low number of specialists and given the increase in demand, this will potentially create a serious talent gap. The additional public chargers require cumulated investments in equipment and infrastructure of 190bn€. Significant state subsidies support the financing of the infrastructure growth (currently Germany is supporting 80% of that growth with state subsidies). Overall, the needed invest can be manageable considering a cumulated EU-27 state budget of almost 7.500bn€ in 2021.

Comparisons on the availability of chargers drawn from across European countries indicate significant variations ranging from two to 24 electric vehicles (EVs) per charger. In comparison to other European countries, Eastern European countries in particular have less public charging points per 100km2. Accessibility of charging stations is already established by large networks with direct credit card payment on the rise. The biggest networks provide access to more than 300.000 public chargers across Europe.

Players in the EV ecosystem need to improve customer experience by partnering and vertical integrations. The EV charging ecosystem is developing from proliferation to consolidation. While the fragmented market prevents a seamless customer journey with split strategic control points, thanks to consolidation the customer experience will improve significantly.

Charging innovations need to overcome remaining challenges to further increase overall attractiveness of EVs. Wireless inductive charging might help to provide increased convenience especially for (autonomous) fleets and enable en-route charging. However, currently the high costs and weight of the hardware are impeding the wide application. (Inverted) pantographs provide a solution for fast charging in depots or stops, as well as en-route charging possibilities (e.g., on high-ways). Bi-directional charging might become the game changer for balancing energy demand either in Vehicle-to-grid (V2G) or vehicle-to-home (V2H) use cases. Especially in regions with vulnerable infrastructure and certain risk of power failures, bi-directional charging can support in providing emergency power.

More than 10 million additional public charging stations are missing.

Europe relies on a widespread network of fuel stations. More than two thirds of existing fuel stations will not survive if they do not adapt to the changing market demands. Given the fast increase of electric vehicles and the changing fuel mix, refueling will no longer be the main business driver. The effect will be intensified by a diverse and extensive out-of-station charging network. Therefore, fuel stations will undergo a radical transformation – to survive, they need to become smart service stations with additional service offerings like automated go-to-market stores for daily errands, last mile delivery or mobility solutions.

Since the aim is to also electrify heavy-duty electric trucks, there is need for a separate public infrastructure. Over 80% of long-haul journeys above 500km are driven on highways. During these journeys, the drivers need to take mandated breaks. Hence, megawatt fast charging (1-3,5 MW) will be necessary along European highways to ensure sufficient charging during breaks. The charging stations require a connection to the high voltage grid with lead times between 5-10 years which is why cooperations with grid operators will be crucial.

In order to realize these ambitious targets, it is critical to develop a comprehensive growth strategy for charging networks, as well as a roadmap for fuel stations to adapt additional business models. Therefore, early coordination and goal-oriented planning between the involved stakeholders, as well as highly reliable strategic partners for transformative and innovative solutions are all decisive success factors.

Battery

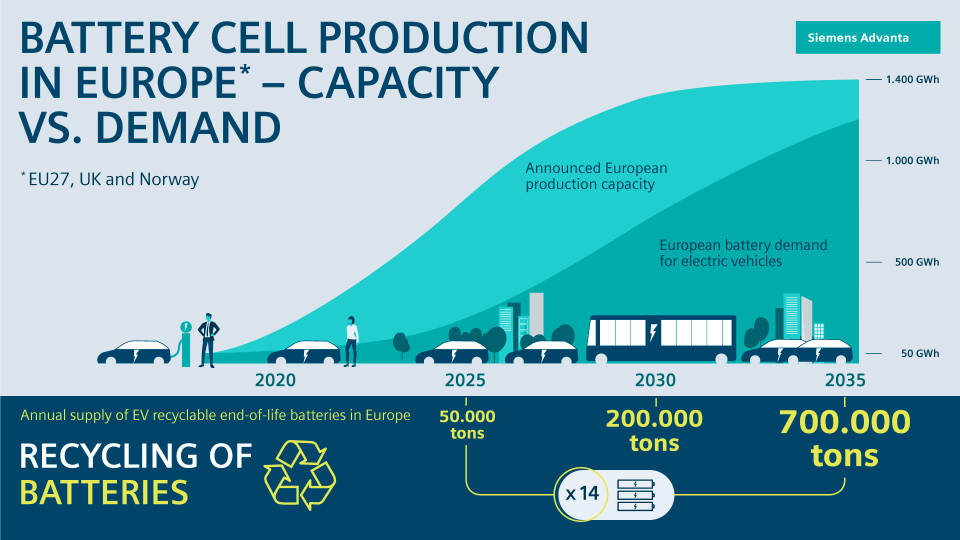

Major challenges lie within the areas of battery production capacity: the dependencies within the supply chain as well as recycling capabilities. Based on projections, in 2035 the battery cell production demand in Europe will reach 1.300GWh. Therefore, a 26-time higher battery cell production capacity will be needed. According to indications stemming from OEMs and battery manufacturers for new Gigafactories that the demand could already be met by 2030. To achieve this goal, strategic partnerships and joint battery production will be crucial.

Furthermore, as of today, more than 75% of mineral refining and battery cell production is controlled by China. It is a challenge of utmost importance for Europe to secure access to minerals and also expand processing and cell production capabilities to reduce supply chain dependencies and political risks. New sourcing strategies are needed including the ramp up of local processing activities in Europe and global supply contracts.

In addition, many electric vehicles will reach their expected end of life by 2035. Therefore, the need for battery recycling is expected to blow up with 700.000 tons of end-of-life batteries in Europe. To meet EU material recovery targets and improve ESG responsibility, new recycling strategies are needed. With the right measures, this could create a great opportunity as Europe will gain an importance source of battery minerals through circular economy measures.

The goal for the next few years should primarily be, first, to localize the necessary production capacities for battery cells, second, to reduce dependencies, and third, to strive for the circular economy. Thus, ecosystems are more important than ever to foster collaboration, co-creation, and innovation.

It is of great importance for Europe to secure access to minerals and to develop processing and cell production capacities in order to reduce dependencies in the supply chain and political risks.

People

The rapid change to EV production affects future employment along the entire automotive value chain in Europe. Massive re-skilling of workforce towards future jobs and competences is required throughout the industry. Overall, the impact is expected to account for a reduction of 900.000 jobs. This equals around 3% of all jobs in the European manufacturing sector. Supplier of powertrain components and OEMs will face the biggest challenges due to fewer engine parts and a high degree of automation within battery production. Furthermore, the increase of online sales directly to the customer will lead to fewer dealerships. In addition, less maintenance frequencies and reduced effort will lead to employment adjustments following the electric vehicle share in active car parc.

The key target will be to evaluate future skills as well as needed competence and to systematically drive re-skilling of workforce.

About the study

For the study “All-electric 2035” Siemens Advanta Consulting analyzed what it takes to enable the transition 2035 to an all-electric mobility in Europe. Several factors were analyzed in between October and December 2022. Results are based on secondary research and reinforced by industry experts.

Industry experts

Battery Manufacturing Assessment

Battery Manufacturing Assessment

Handling data across the EV battery life cycle

With global mandates, regulations and ambitions being set to decarbonise industries, focus and investment is moving towards advancing manufacturing and processing capabilities in the renewable energy and battery technology space.

While R&D in the EV space increases and organisations determine the type of alternative fuel cells or battery chemistries that can optimise their vehicle performances, whether in the consumer or commercial markets, there is also an acceleration in progress as they seek to secure further investment to plan manufacturing or gigafactory facilities and optimise supply chains.

As the EV market continues to grow, manufacturers are looking for ways to provide a cost effective and sustainable solution from cradle to grave that will secure and retain their footing in this new market.

We’ve developed the battery manufacturing assessment to help clients fully understand the capital and operational cost breakdown, and carbon intensity, of battery manufacturing across different cell types, chemistries and scale.

Our battery manufacturing assessment also helps our clients make informed strategic decisions about how to optimise their investments and make business-critical make vs buy decisions.

Our approach

Having a clear view from the client on their ambitions for the battery cell type, chemistries and specifications they want to manufacture as well as operational data is key to build a solid foundation of cost base at a BoM level. This sets the baseline across all known and certain costs.

Using our manufacturing expertise we build in manufacturing process and equipment costs with an added carbon intensity lens that starts giving shape to the capital investment required to set up manufacturing cells. Our application of macroeconomic data allows us to look at both manufacturing locations of raw materials or semi-finished goods that will make part of the full BoM.

We understand that battery technology is still new in the market, and there are some costs that will be unpredictable or even volatile, using our commercial cost modelling expertise and live data feeds, we are able to provide a degree of accuracy in our model at a granular level that can be used and tested in the market as part of the client’s make vs buy decision making process. Based on the client and macro data available, our model will be bespoke and our assumptions will be tested in collaboration with our client.

Once the model has undergone ergonomics and functionality testing using a set of example cases, the model is ready to be launched for use by the client’s functions, such as Procurement and Cost Engineering, to test the marketplace.

All-Electric-2035

Learn how Siemens Advanta is transitioning companies to an all-electric future.

The benefits of best practice

By having a breakdown across operational and capital costs, organisations are able to determine the total impact of battery manufacturing on their business. This can shape discussions at board level on the potential level of investment and capability required to establish operations across new and emerging technologies in a more tangible way.

The outputs of the tool can be leveraged to test the market at varying stages of the BoM, enabling clients to make better make vs buy decisions that will give them access to the right capabilities and manufacturing technology, and ultimately secure speed to market in a commercially optimal manner.

A drive for sustainability globally creates complex challenges for the supply chain, from raw material access to competition for capital equipment and labour. Our battery manufacturing assessment helps clients scale up cell manufacturing in a sustainable and maintainable way to meet production demand and grow the bottom line across a new and developing portfolio of technologies.

Our industry leaders

End-of-Life/Recycling-Management

End-of-Life/Recycling-Management

A multitude of external factors, such as increasing commodity prices, stricter regulatory requirements, and material shortages due to geopolitical conflicts (decoupling), turn the sustainable handling of products towards the end of their life cycle into a decisive competitive factor. Derived from practical expertise, our consulting offering helps efficiently secure your supply and market access by closing the circular loop.

- Developing effective and profitable end-of-life programs to support growth and sustainability

- Ensuring long-term access to competitively priced strategic secondary materials

- Creating partnerships and ecosystems to enable circular models

- Leverage R-strategies (e.g., reuse, reman, recycle) to preserve components and materials in a closed loop

- Reduce your carbon footprint through increased use of recycled materials

- Increase resilience of your supply chain through reduced dependency on primary resources

- Grow revenue through new circular business models (e.g., as-a-service, repair, remanufacture)

- Improve brand reputation and customer loyalty through sustainable practices

Our industry leaders

Circular Economy

Circular Economy

A growing concern for sustainability, combined with raw material scarcity, necessitates closing the loop and developing new circular solutions. Our consulting services can assist your business in navigating this transformation. With decades of expertise in sustainability, product lifecycle management, and product architecture design, we can support you in implementing solutions that not only benefit the environment but also increase profitability and stakeholder value. Contact us today to find out how we can help your business become a leader in circularity.

- Definition of appropriate R-Strategies for designing products, components, and services

- Regulatory check and maturity assessment

- Product (architecture) design strategy

- Determine R-strategies for your specific situation - as each product and service requires a tailored approach

- Develop a best-fit modular architecture to reflect circular requirements

- Provide your engineers with guardrails to develop more sustainable products and services

- Use best-in-class technology to increase your sustainability

- Gain a competitive advantage by being at the forefront of complying with upcoming regulations

Our industry leaders

Facilitating Achievement of ESG & Net Zero Goals for Buildings & Campuses

Facilitating Achievement of ESG & Net Zero Goals for Buildings & Campuses

Digital Transformation of your Properties

Keeping your building portfolio compliant with new regulations and reaching ESG (Environmental, Social and Governance) goals in today’s ever-changing environment is not an easy task. It will not be sufficient to optimize the individual processes and management systems within a building. Digitalization, integration, and coordinated, centralized management will be key as holistic, sustainable decisions can only be made with full transparency.

From sustainability strategy to implementation, we support the digital transformation of your properties. Take the transformative path with us – from setting a goal to potential analysis to blueprint and piloting up to implementation and rollout.

Together, we will find the right way to begin your ESG project – regardless of your current status.

We support in reducing the risk of “stranded assets”

Tackle the challenge of early economic obsolescence of buildings that get devaluated and are non-performing.

We help define your decarbonization pathway to comply with regulatory energy efficiency standards. By focusing on your sustainability goals, also tenant expectations can be met leading to reduced vacancies and higher rents.

Being able to measure, report and improve data relating to energy, water and waste is a core success factor in this respect.

Find out how we can support the Digital Transformation of your Building Portfolio

Our Offering to Support Your Digitial Transformation Journey towards achieving ESG And Net Zero Goals

- Definition of ESG and Net Zero strategy for the building portfolio

- Prioritization of ESG and Net Zero topics and relevant criteria/KPIs and use cases to increase ESG rating

- Assess potential risks and develop an action plan for the portfolio

- Structured inventory of existing buildings, systems, data

- Target-actual comparison to identify required data

- Business case and feasibility study for digital solutions and to improve defined ESG and Net Zero KPIs

- System architecture blueprint and organizational transformation plan

- Listing/ evaluation of possible technical solutions and partners

- Project planning

- Turn-key implementation with technical solutions, products and support for organizational transformation

Guide your path to better ESG ratings and Net Zero

Reduce vacancies and achieve higher rents by exceeding tenant expectations towards sustainability

Support on a modular basis or with a comprehensive solution

Bridge sustainability, technology, and the real estate market

Circularity Program Setup

Circularity Program Setup

Difficulties in sourcing strategic materials, supply chain disruptions, increasing CO2 emissions, and new regulatory requirements are accelerating the adoption of the circular economy. However, the circularity ecosystem (e.g., regulations, standards, collaborative initiatives) can be overwhelming and a real challenge for industrial players. Siemens Advanta supports businesses in creating a common circularity view, identifying key impact categories, building integrated ecosystems along value chains, and navigating the road to circularity.

- Define a strategy to anchor circularity in companies' daily business, e.g., by designing more reusable/recyclable products

- Increase supply chain resilience, e.g., by securing access to strategic materials

- Gain transparency on upcoming regulations and prepare for them, e.g., the Circular Economy Action Plan of the EU

- Leverage ecosystems along the value chain and enable data sharing to truly close the material loop, e.g., via digital product passports

- Develop new business models by closing the loop, e.g., with as-a-service business models

Our industry leader

Scope 3 & Sustainable Supply Chain Optimization

Scope 3 and Sustainable Supply Chain Optimization

A significant amount of a company's CO2 emissions is generated from its supply chain. Effectively managing Scope 3 emissions and optimizing sustainable supply chain practices is crucial for reducing overall carbon footprint and mitigating risks. We provide solutions that create transparency by evaluating the current Scope 3 footprint of a company as well as assisting in setting and achieving specific emission reduction targets. This serves as the basis for promoting sustainability considerations in procurement decisions and effectively communicating reduction requirements to suppliers, leading to a more responsible and eco-friendly supply chain.

- Calculate carbon emissions from various sources, such as estimating suppliers' emissions based on industry estimates

- Receive custom visualizations for a quick overview and insights, such as identifying suppliers with the highest carbon footprint

- Obtain customized reporting and in-depth risk analysis per country, product type, and more

- Assess suppliers' performance by refining data via a questionnaire, such as calculated emissions, targets, and reduction measures

- Streamline communications and interactions with suppliers, fostering the journey from transparency to actual emission reduction, such as coupling purchasing decisions with sustainability criteria

Our industry leaders

ESG Strategy & Governance

ESG Strategy and Governance

We help organizations develop comprehensive ESG strategies and governance frameworks tailored to their unique needs. Our approach helps businesses to identify key ESG topics, establish ambitious goals, and create a clear roadmap for implementation. With our expertise organizations can capitalize on ESG opportunities while satisfying the demands of diverse stakeholder groups.

- Gain transparency on organizations’ ESG activities and regulatory requirements, e.g., by identifying and streamlining competing initiatives across the company

- Develop a clear sustainability vision and roadmap that aligns with business objectives and values, e.g., by conducting materiality assessments

- Establish and prioritize measurable targets and KPIs to effectively track ESG performance and success, e.g., a carbon neutrality timeline or a goal for circularity

- Install a dedicated and integrated governance system with clearly defined roles and responsibilities, e.g., dedicated sustainability responsible per organizational unit

- Implement a robust reporting infrastructure to enhance transparency and accountability on ESG matters, e.g., automated reporting dashboards with core KPIs

Our industry leader

Change Management

Change Management

Siemens Advanta has a great track record of successful change initiatives, from organizational setup changes to business turnarounds and implementing new business models. If you have a strict timeline and set target dates, we will implement well-planned and defined strategies that have been proven to yield the best results.

- Clarify: Future and current state

- Design: Holistic change program

- Act: Implementation of the change desired

- Sustain: Anchoring of change long-term

-

Ensure productivity

Lower the decrease in productivity as teams adjust to the new organizational structure or workflows. -

Secure retention rate

Lower the expected turnover rate as the transformation may not align with the expectations or career goals of all employees. -

Achieve buy-in for the transformation

Buy-in may be challenging to achieve regarding the need for digitsl transformation, the advantages of the new operating mode, the fairness and involvement in the transformation process, and clarity about future positions. -

Safeguard change readiness

Make sure that people are prepared in terms of change history, stress levels, capabilities and resources committed.

Our industry leader

Sustainability Check-up

Sustainability Check-Up

Quickly assessing a firm's sustainability maturity is essential in the jungle of increasing customer requests and constantly changing regulations. Companies need to understand where they are on their sustainability journey. Siemens Advanta's Sustainability Check-up is a quick two-week assessment of a company's maturity level. It accelerates their sustainability transformation through concrete recommendations to tackle future challenges.

- Receive a unique sustainability maturity profile, with an overarching ESG score across 16 categories

- Get best-in-class insights accompanied by tailored recommendations and concrete next steps

Our industry leader

Pagination

- Previous page

- Page 3

- Next page

Contact Us

Contact Us